The Indian stock market is a dynamic and vibrant landscape, with two prominent indices serving as the backbone of investor sentiment and decision-making – the Nifty and the Sensex. While these two benchmarks are frequently used interchangeably, Nifty and Sensex possess distinct characteristics that differentiate them.

Understanding the nuances between these two indices is crucial for investors, as it can significantly impact their investment strategies and portfolio performance. Whether you’re a seasoned market veteran or a newcomer to the world of investing, grasping the differences between Nifty and Sensex is essential for navigating the complexities of the Indian stock market.

Let’s delve into the world of Nifty vs Sensex, exploring the unique features and variations that define these two titans of the Indian stock market.

Understanding Stock Market Indices:

Nifty vs Sensex, as two leading stock market indices in India, are more than just numbers on a screen – they are powerful tools that provide valuable insights into the ebb and flow of the country’s financial ecosystem.

At their core, stock market indices are calculated based on the prices of a select group of stocks chosen to represent the broader market. These constituent stocks are weighted based on market capitalization, liquidity, and sector representation.

By tracking the fluctuations in these indices, investors, analysts, and policymakers can gauge the overall sentiment and direction of the stock market. This information is crucial for making informed investment decisions and understanding the broader economic trends that shape the investment landscape.

History and Inception of Nifty and Sensex:

The Bombay Stock Exchange (BSE) Sensex, often referred to as the “Sensex,” is recognized as the oldest stock index in India. Introduced in 1986, the Sensex provides a broad-based, market-weighted indicator of the performance of the Indian equity market. Initially comprising 30 of the most liquid and large-capitalized companies, the Sensex has since evolved to reflect the changing dynamics of the Indian corporate landscape.

In contrast, the National Stock Exchange (NSE) Nifty, or the “Nifty,” was introduced in 1996 as a newer and more comprehensive index. Conceived to track the performance of the 50 most significant and liquid stocks across diverse sectors, the Nifty serves as a more representative barometer of the Indian stock market.

The inception of the Nifty was a strategic move by the NSE to provide a more diversified and inclusive index, addressing the limitations of the Sensex, which primarily consisted of a few sectors and companies. This difference in the underlying composition and methodology has contributed to the distinct identities and investment applications of the Nifty and Sensex over the years.

The divergent histories and methodologies of the NSE or BSE indices have shaped the ongoing debate and analysis around the key differences between these two prominent barometers of the Indian stock market.

Differences Between Nifty and Sensex:

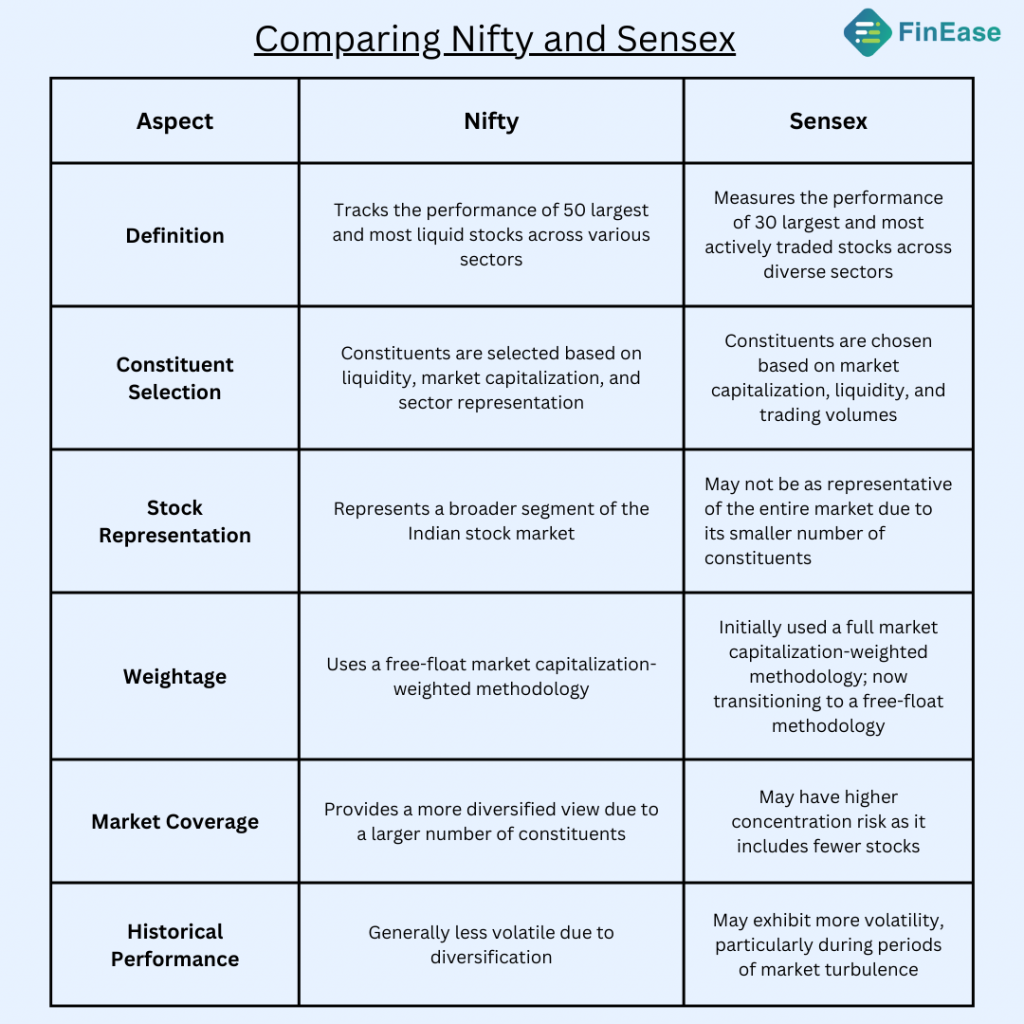

The table delineates differences between the Nifty and Sensex indices regarding constituent selection, representation, methodology, and historical performance.

Number of Constituent Stocks:

One of the primary differences between the Nifty and Sensex lies in the number of constituent stocks that make up each index.

The Nifty index comprises 50 stocks, representing the 50 liquid companies traded on the National Stock Exchange (NSE). This broader range of constituents enables the Nifty to present a more comprehensive reflection of the performance of the Indian equity market.

In contrast, the Sensex consists of 30 stocks, representing the 30 actively traded companies listed on the Bombay Stock Exchange (BSE). Despite its smaller number of constituent stocks, the Sensex is a reliable barometer of the overall market sentiment.

The difference in the number of constituent stocks between the Nifty and Sensex has important implications. The Nifty’s large base provides greater diversification, potentially reducing the impact of individual stock movements on the index’s performance. Conversely, the Sensex, with its narrower base, may be more susceptible to the influence of a few large, blue-chip companies.

Rebalancing and Review Process:

The Nifty and Sensex indices undergo periodic rebalancing and review processes to ensure they accurately reflect the evolving dynamics of the Indian equity market. However, the approach taken by each index is distinctly different.

The Nifty index is reviewed and rebalanced semi-annually, with the index committee closely monitoring the constituents’ market capitalization, liquidity, and sectoral representation. This frequent review allows the Nifty to quickly adapt to the changing market dynamics, keeping it a reliable and up-to-date benchmark.

Sensex follows a more infrequent review cycle, with the constituents typically updated annually. While this approach provides stability, the Sensex may lag in reflecting the latest trends and developments in the Indian corporate landscape.

These divergent rebalancing practices contribute to the unique identities of the Nifty and Sensex. The Nifty’s nimble rebalancing process appeals to those seeking a more dynamic and responsive index, while the Sensex’s relative stability may attract investors with a more long-term outlook.

Performance Comparison:

When considering the performance of the Nifty and Sensex, a noticeable distinction becomes evident. Over the past decade, the Nifty has consistently outpaced the Sensex in overall returns, reflecting its broader representation of the Indian equity market.

The Nifty’s composition of 50 stocks, prioritizing large-cap and high-growth companies, has enabled it to capture the upswings in the market. Conversely, the Sensex’s 30-stock portfolio, comprising some of the most prominent blue-chip firms, has been relatively more susceptible to the volatility experienced by individual constituents.

This performance differential has significant implications for investors, as it underscores the Nifty’s ability to serve as a more comprehensive benchmark for evaluating the overall health and growth potential of the Indian stock market. In contrast, the Sensex may be more suitable for investors seeking to gauge the sentiment and performance of the country’s corporate titans.

Usage and Applications:

Both indices have a wide range of applications in the Indian financial ecosystem, catering to the diverse needs of investors, traders, and market participants.

The Nifty is the underlying benchmark for multiple investment products, including index funds, exchange-traded funds (ETFs), and derivative instruments. It makes the Nifty a popular choice for investors seeking broad-based exposure to the Indian stock market.

While the Sensex, with its focus on the country’s blue-chip companies, is often used as a barometer for the overall health of the Indian economy and as a reference point for evaluating the performance of actively managed funds. The Sensex also serves as the basis for various investment strategies, such as sector-specific or thematic investing.

The choice between the Nifty and Sensex ultimately depends on the investor’s investment objectives, risk tolerance, and the specific investment strategies they wish to employ.

Choosing Between Nifty and Sensex:

Deciding between the Nifty and Sensex indices is a decision that should driven by an investor’s investment objectives, risk appetite, and the specific needs of their portfolio.

For investors seeking a broad, diversified exposure to the Indian equity market, the Nifty may be the more suitable choice. With its 50-stock composition, the Nifty provides a comprehensive representation of the country’s largest and most liquid companies, making it an ideal benchmark for tracking the overall performance of the Indian stock market.

On the other hand, the Sensex, focusing on the 30 most prominent and influential companies, may be more appealing to investors who prefer the country’s blue-chip stocks. The Sensex can serve as a valuable tool for evaluating the sentiment and performance of India’s corporate giants and can be particularly useful for those with a more conservative investment approach.

Advantages and Limitations:

The Nifty and Sensex indices offer distinct advantages and limitations that investors should consider when making investment decisions.

Advantages of the Nifty:

- Broader representation of the Indian equity market

- Higher market capitalization coverage

- Better capture of overall market trends and growth potential

- Suitability for index-tracking investment products

Advantages of the Sensex:

- Focus on the country’s most prominent and influential companies

- Serves as a reliable barometer for the performance of blue-chip stocks

- Provides stability and consistency in its constituent composition

- Familiarity and widespread recognition among investors

Limitations of the Nifty:

- Potential susceptibility to volatility due to its broader composition

- The rebalancing process may introduce short-term disruptions

Limitations of the Sensex:

- Narrower representation of the Indian equity market

- May lag in reflecting the latest trends and developments

- Relatively lower market capitalization coverage

Understanding the trade-offs between these advantages and limitations is crucial for investors to make informed decisions and align their investment strategies with the index that best suits their risk profile and investment objectives.

Impact on Investment Decisions:

Investors seeking broad exposure to the Indian equity market may find the Nifty more appealing, as its 50-stock composition allows for greater diversification and the potential to capture the overall market growth. It benefits long-term investors or those aiming to build a well-rounded portfolio.

Investors focusing on the country’s blue-chip companies or a more conservative investment approach may gravitate towards the Sensex. The Sensex’s 30-stock portfolio, which includes some of India’s most established and financially stable corporations, can provide stability and potentially lower volatility within an investment portfolio.

Ultimately, investors should base their decision to invest in the Nifty or Sensex on carefully evaluating their risk tolerance, investment horizon, and specific goals.

Conclusion:

While both the Nifty and Sensex serve as benchmarks for the performance of Indian stocks, the distinctions between these two indices are significant and far-reaching. From the number of constituent stocks and market capitalization coverage to the rebalancing processes and investment applications, each index offers investors a unique perspective and set of advantages.

As you navigate the diverse landscape of the Indian equity markets, remember that the choice between the Nifty and Sensex is not a one-size-fits-all proposition. It’s a decision that should based on your unique investment objectives, risk appetite, and the role you envision these indices playing in your overall portfolio.