Investing in the stock market can be an exciting and rewarding endeavor, but for beginners, navigating the complexities of stock exchanges can be daunting, especially when selecting a stock exchange between NSE or BSE, which is better.

Two major stock exchanges dominate the financial landscape in India: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These platforms serve as the backbone of the country’s capital markets, facilitating the buying and selling of stocks, bonds, derivatives, and other financial instruments.

Whether you’re a seasoned investor or just starting your investment journey, understanding the nuances of these exchanges is crucial. The NSE and BSE, while sharing some similarities, differ in their histories, operational models, and market dynamics. Choosing the right platform can significantly impact your investment strategies and overall success.

This beginner’s guide aims to demystify the world of Indian stock exchanges by providing an in-depth look at the NSE and BSE. We’ll explore their origins, unique features, and the factors behind their respective growth and popularity.

Understanding NSE and BSE: The Major Stock Exchanges of India

Established in 1992, NSE is a relatively new entrant but has swiftly become India’s largest stock exchange by market capitalization. It introduced electronic trading to the Indian market, ushering in a new era of efficiency and transparency. The NSE’s benchmark index, the Nifty 50, comprises the top 50 companies across various sectors.

On the other hand, the BSE holds a rich legacy dating back to 1875, making it Asia’s oldest stock exchange. It pioneered the introduction of the S&P BSE Sensex index in 1986, which tracks the performance of 30 influential companies listed on the exchange.

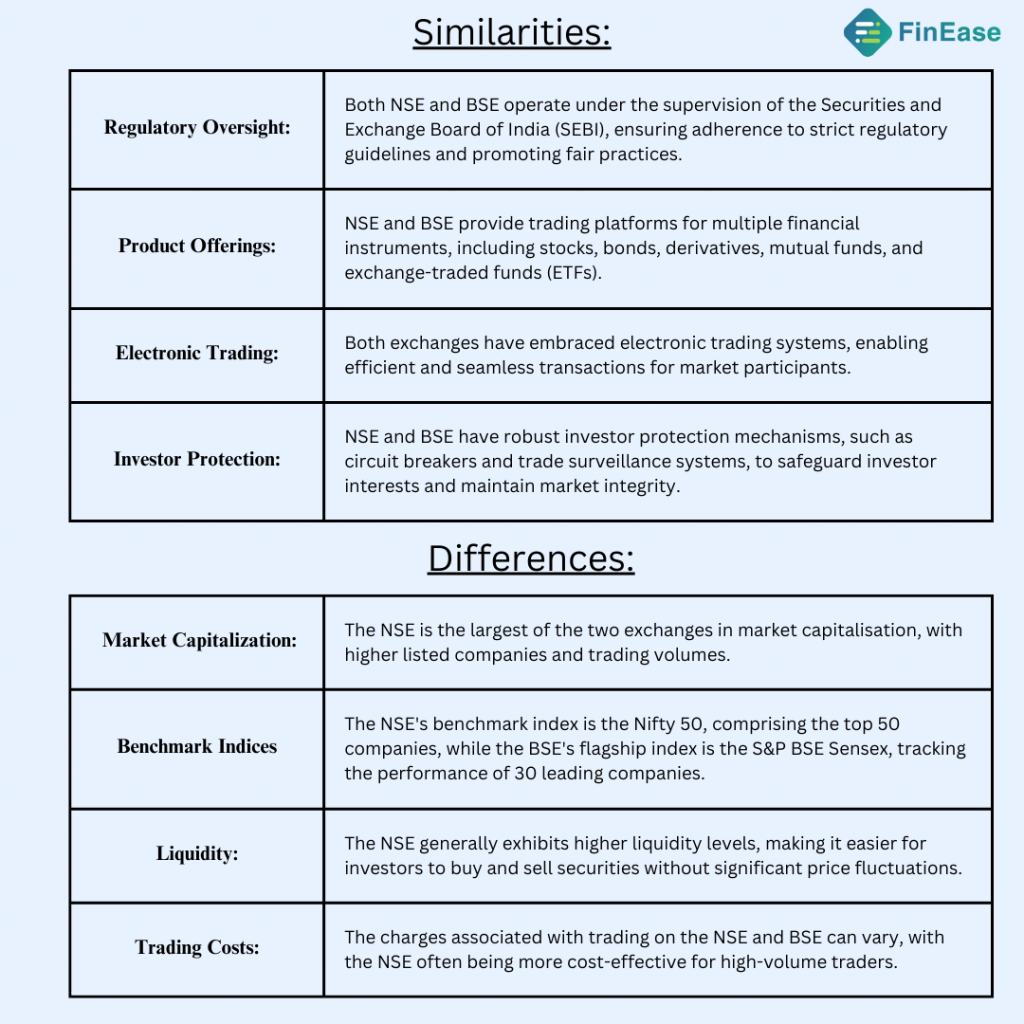

The NSE and BSE operate under the regulatory oversight of the Securities and Exchange Board of India (SEBI), ensuring fair practices and investor protection. While they share similarities in offering trading platforms for various financial instruments, their distinct characteristics have shaped the Indian stock market landscape.

NSE vs BSE: Key Similarities and Differences

Either NSE or BSE are the major players in the Indian stock market. They exhibit several similarities and differences that are important for investors to understand.

The Rise of NSE: Factors Contributing to Its Popularity:

The National Stock Exchange (NSE) has experienced a remarkable rise since its inception in 1992, surpassing the venerable Bombay Stock Exchange (BSE) to become India’s largest stock exchange by market capitalization. Several factors have contributed to the NSE’s increasing popularity among investors and traders.

1. Innovative Product Offerings: The NSE has consistently introduced innovative financial products to cater to the evolving needs of investors. Its early foray into derivatives trading, including futures and options contracts, attracted market participants seeking exposure to these instruments.

2. Focus on Transparency and Disclosure: It emphasized promoting transparency and enforcing stringent disclosure norms. This commitment to ethical practices has instilled investor confidence and helped maintain market integrity, crucial factors in attracting domestic and international investors.

3. Liquidity and Depth: The NSE’s high trading volumes and market depth have made it an attractive destination for institutional investors and high-frequency traders. The increased liquidity has facilitated smoother price discovery and reduced bid-ask spreads, benefiting all market participants.

4. Regulatory Support: SEBI has played a pivotal role in the NSE’s growth by implementing policies fostering innovation and competition in the stock exchange landscape. This regulatory support has enabled the NSE to introduce new products and services more swiftly, giving it a competitive edge.

5. Operational Efficiency: The NSE’s commitment to operational excellence, including robust risk management systems, efficient clearing and settlement processes, and stringent compliance measures, has instilled confidence among market participants, contributing to its growing popularity.

Trading on NSE or BSE as a Beginner Investor:

As a beginner investor in the Indian stock market, one of the crucial decisions you’ll face is whether to trade on the NSE or BSE. Both platforms have their unique trading environments, features, and characteristics. Here’s a closer look at what you should consider as a novice trader when choosing between the NSE and BSE.

1. User-Friendliness and Learning Resources:

The NSE is known for its user-friendly trading platforms and comprehensive educational resources.

The exchange has dedicated investor education initiatives, providing beginners with valuable tools and resources to navigate the stock market effectively.

Additionally, the NSE’s website offers intuitive interfaces and robust trading applications, making it easier for newcomers to familiarize themselves with the trading process.

2. Liquidity and Trading Volumes:

As a beginner, liquidity is a critical factor to consider. The NSE generally exhibits higher trading volumes and liquidity levels, which can facilitate smoother entry and exit points for your trades.

Higher liquidity also means narrower bid-ask spreads, potentially reducing transaction costs.

3. Product Diversity:

While both exchanges offer a wide range of investment products, the NSE has been at the forefront of introducing innovative instruments like derivatives, currency futures, and exchange-traded funds (ETFs).

If you’re interested in exploring these diverse investment options, the NSE may be the better choice for a beginner looking to diversify their portfolio.

4. Technology and Trading Infrastructure:

The NSE’s state-of-the-art trading infrastructure and advanced technology have been instrumental in its success.

As a beginner, you may benefit from the NSE’s efficient order execution, real-time market data, and robust risk management systems, which can enhance your overall trading experience and help you navigate the market effectively.

5. Cost Considerations:

Transaction costs, including brokerage fees and other charges, can vary between the NSE and BSE.

As a beginner with potentially smaller trade volumes, it’s essential to compare the fee structures of both exchanges and choose the one that aligns with your budget and trading frequency.

6. Stock Availability:

While most major companies are on both exchanges, there may be instances where a particular stock is available only on one platform. If you have a specific stock in mind, check and trade it on your preferred exchange.

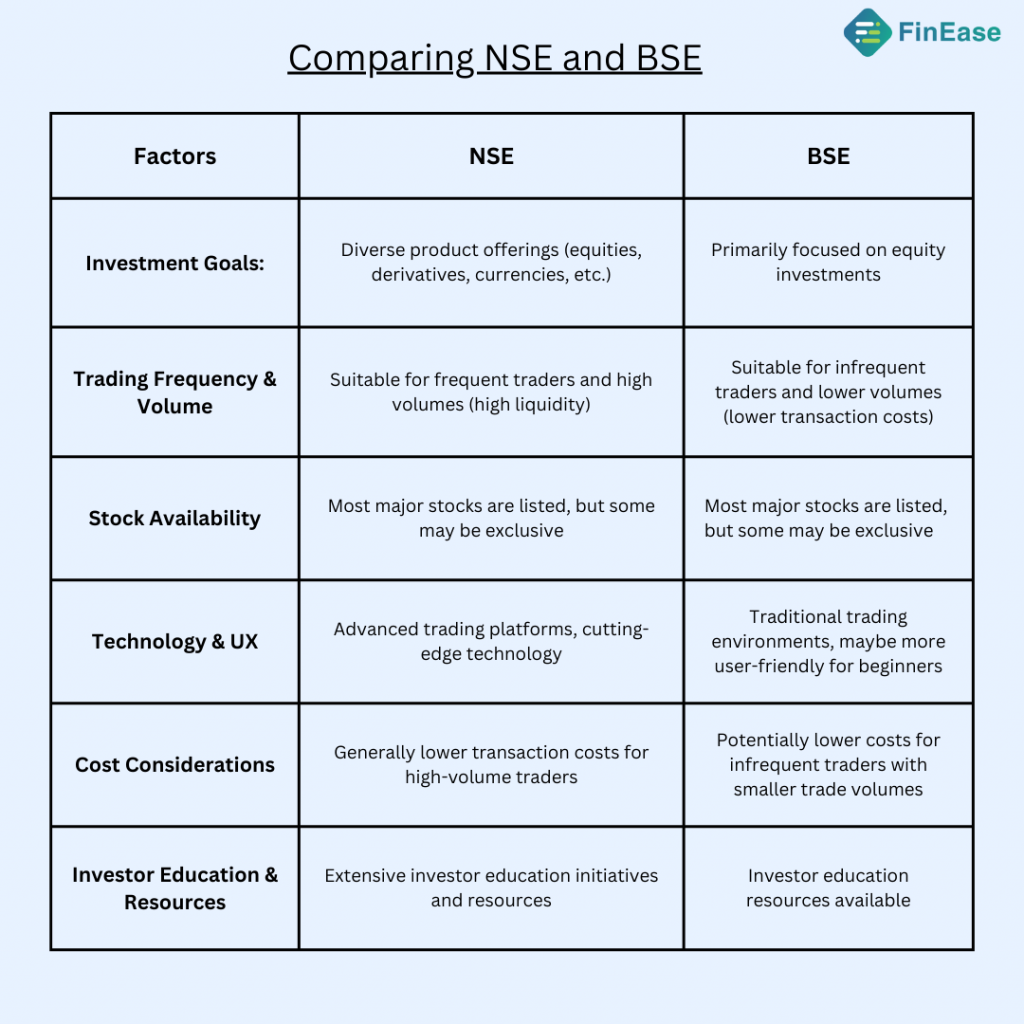

Comparing NSE and BSE: Which Platform Suits You Better?

Choosing the right stock exchange platform can significantly impact your investment experience and potential returns. It’s essential to consider your investment goals, trading style, and preferences to determine which platform suits you better.

Wrapping Up:

Choosing between the NSC or BSC as an investor or trader is a decision that requires careful consideration of your investment goals, trading style, and personal preferences.

The NSE’s cutting-edge technology, diverse product range, and high liquidity make it an attractive option for frequent traders and those seeking exposure to various asset classes. Conversely, the BSE’s historical significance, user-friendly interface, and potentially lower transaction costs may appeal to infrequent traders and those focused primarily on equity investments.

Ultimately, the decision should be based on a comprehensive evaluation of your unique requirements, risk tolerance, and trading preferences. It’s advisable to consult with experienced professionals, conduct thorough research, and potentially leverage the services of both exchanges to maximize your investment opportunities.